Maximize Your Earnings: The Ultimate Pro Time-and-a-Half Calculator – In today’s fast-paced world, where time is money, maximizing your earnings is crucial. Whether you’re a full-time employee, freelancer, or business owner, understanding how to leverage your time effectively can significantly impact your bottom line. One key aspect of this is knowing how to calculate and make the most of overtime pay. In this article, we’ll explore the importance of time-and-a-half pay, its calculation, and how utilizing a pro time-and-a-half calculator can help you optimize your earnings.

Understanding Time-and-a-Half Pay

Time-and-a-half pay, commonly referred to as overtime pay, is a remuneration rate where employees receive 1.5 times their regular hourly wage for hours worked beyond the standard 40-hour workweek. This incentive serves as both a reward for employees for their extra effort and a cost-control mechanism for employers, encouraging them to manage resources efficiently.

The concept of time-and-a-half pay is governed by labor laws in many countries, mandating employers to compensate employees accordingly for their extra hours worked. However, the specifics of these regulations may vary, making it essential for both employees and employers to understand the applicable laws in their respective jurisdictions.

Importance of Maximizing Earnings

Maximizing earnings goes beyond simply increasing revenue; it’s about optimizing the value of your time and effort. For employees, leveraging overtime opportunities can significantly boost their income, helping them achieve financial goals faster, whether it’s paying off debt, saving for retirement, or investing in personal development.

For businesses, effectively managing overtime pay ensures that resources are utilized efficiently while maintaining employee satisfaction and productivity. By understanding and optimizing overtime costs, companies can enhance their profitability and competitiveness in the market.

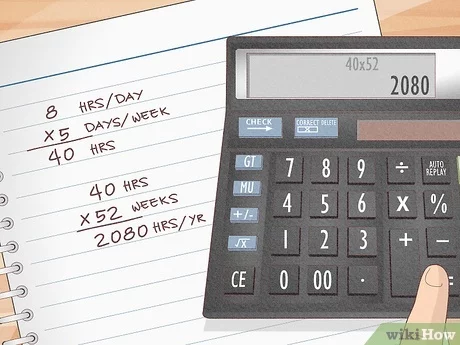

Calculating Time-and-a-Half Pay

Calculating time-and-a-half pay involves a straightforward formula: multiplying the regular hourly rate by 1.5 for every hour worked beyond the standard workweek. However, this calculation may vary depending on factors such as local regulations, company policies, and employee contracts.

To illustrate, let’s consider an employee who earns $20 per hour and works 50 hours in a week. The regular pay for the first 40 hours would be $800 ($20 × 40), and the overtime pay for the additional 10 hours would be $300 ($20 × 1.5 × 10), totaling $1,100 for the week.

While the calculation seems simple, manually computing overtime pay for various scenarios can become tedious and prone to errors, especially for businesses with multiple employees. This is where a pro time-and-a-half calculator comes into play.

The Role of a Pro Time-and-a-Half Calculator

A pro time-and-a-half calculator is a valuable tool designed to streamline the process of computing overtime pay accurately and efficiently. These calculators typically feature user-friendly interfaces and customizable settings, allowing employers to input variables such as hourly rates, work hours, and overtime thresholds to generate precise calculations.

One of the primary advantages of using a pro time-and-a-half calculator is its ability to handle complex scenarios with ease. Whether it’s calculating overtime for different pay rates, shift differentials, or bonus structures, these calculators can provide instant results, saving time and minimizing errors.

Moreover, pro time-and-a-half calculators often come equipped with additional features such as reporting capabilities, compliance checks with labor laws, and integration with payroll systems, further enhancing their utility for businesses of all sizes.

Tips for Maximizing Earnings with a Pro Calculator

To maximize your earnings using a pro time-and-a-half calculator, consider implementing the following tips:

- Stay Informed: Keep abreast of relevant labor laws and company policies to ensure compliance and maximize your entitlements to overtime pay.

- Input Accurate Data: Double-check all inputs, including hourly rates, work hours, and overtime thresholds, to ensure accurate calculations.

- Utilize Reporting Features: Take advantage of reporting features to track overtime expenses, identify trends, and optimize workforce management strategies.

- Regularly Review Policies: Periodically review and update overtime policies to adapt to changing business needs and regulatory requirements.

- Train Employees: Provide training to employees on overtime policies, timekeeping practices, and the proper use of the pro calculator to promote transparency and accountability.

Conclusion

In conclusion, maximizing your earnings through effective management of time-and-a-half pay is essential for both employees and businesses alike. By understanding the principles of time-and-a-half pay, leveraging the capabilities of a pro time-and-a-half calculator, and implementing best practices, individuals and organizations can optimize their financial outcomes while ensuring compliance with relevant regulations. So, take control of your earnings today and unlock the full potential of your time.